Custom Brokerage

"We'll clear the way for your imports so that you can focus on your business - with our expert customs brokerage service."

Custom Brokerage

We help importers comply with the laws and regulations of the country they are importing goods into and to clear their goods through customs.

The primary services provided include:

- Classifying the goods

Determining the correct Harmonized System (HS) code for imported goods and determining the duty and taxes that the importer must pay.

- Filing the necessary paperwork

We prepare and submit the required documentation to the customs agency, including the commercial invoice, bill of lading, and other relevant documents.

- Advise on compliance

Ensuring that the importer is aware of and in compliance with any regulations or laws that apply to the imported goods.

- Payment of duties and taxes

Arranging for payment of any duties and taxes owed on the imported goods.

- Monitoring and tracking

Tracking the shipment’s status and providing updates to the importer throughout the process.

Let us help you navigate the complex regulations and procedures related to importing goods and ensure compliance with all laws and regulations while streamlining the process and reducing delays.

Get a Quote

We provide fast, reliable, and affordable shipping services for businesses of all sizes.

Our team of experienced logistics professionals can help you reduce costs and maximize efficiency on every shipment.

Request a quote now to see how much you could save!

Need more help?

If you have any questions or special requests, please don’t hesitate to reach out.

We look forward to hearing from you!

+1 (956) 526-9090

+52 (33) 2844-0338

Our services

Logistics & Transportation Services

Our team utilizes the latest technology to provide you with real-time tracking of your shipment so that you can stay informed every step of the way.

We are committed to providing the highest quality customer service and strive to ensure that your shipments are delivered on time and with the utmost care.

Dry van (enclosed trailers), flatbed, or specialized equipment based on the type of goods shipped.

Choose between FTL service for large shipments requiring a whole truck and LTL service for smaller loads.

It is provided with various storage equipment, such as racks and shelves, to maximize space and keep goods organized.

Classifying goods, preparing and filing paperwork, advising on compliance, arranging for payment of duties and taxes, and tracking and monitoring shipments.

Wide range of options for shipping your goods, including same-day delivery and express shipping.

Global Positioning System (GPS) technology to track the location and movement of goods or vehicles during transportation.

Move your goods or packages from one vehicle or mode of transportation to another without storage.

Minimize the time goods spend in warehouses and distribution centers by moving them directly from the point of origin to the end of consumption.

A wide range of options for dedicated logistics services, including a dedicated team and resources, such as vehicles and warehouses, are solely focused on fulfilling your logistics needs.

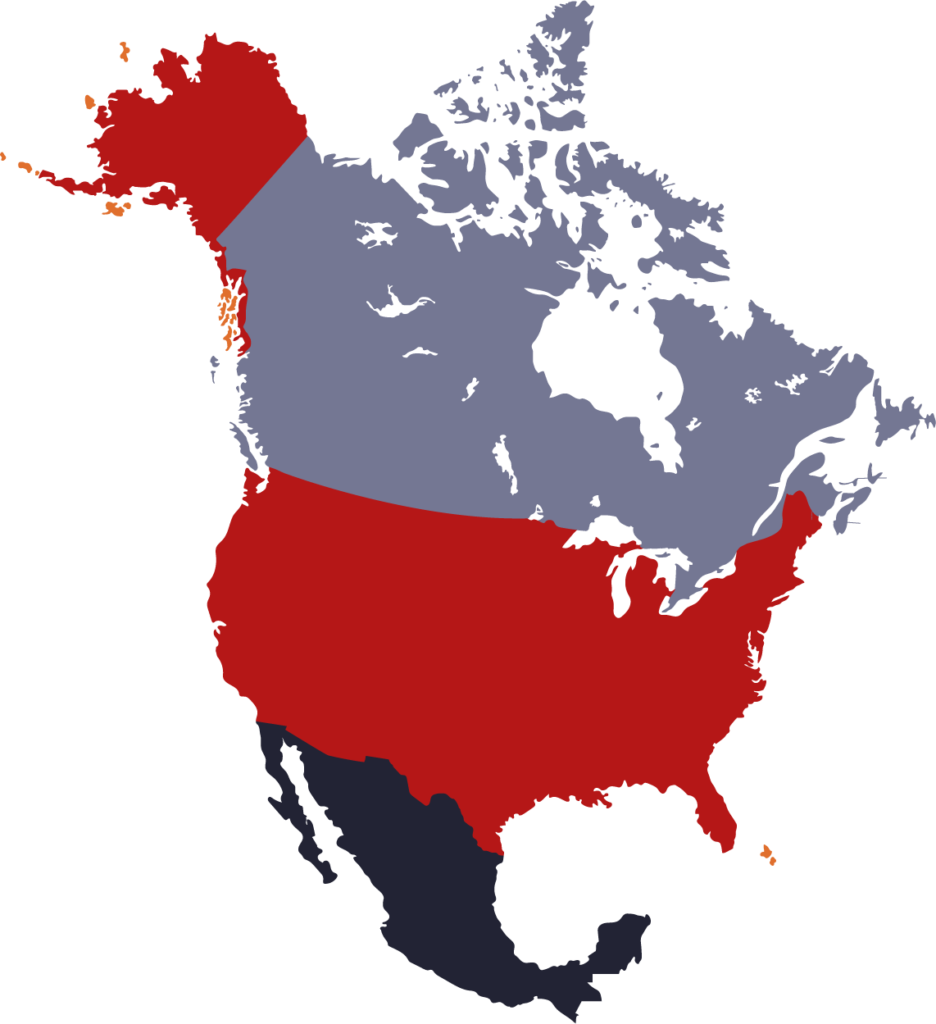

CANADA — USA — MEXICO

When you need experience in logistics in North America, we have it covered.

As the demand for goods and services continues to rise, so do the expectations of customers for faster, more efficient delivery.

North America Reach:

Our extended network of transportation partners allows you to quickly move freight to and from any location in North America.

Comprehensive Solutions:

We offer comprehensive logistics solutions on road transportation for all types of freight based on the type of goods shipped.

Expertise and Experience:

With extensive experience in the industry, we can handle complex logistics challenges; your freight is transported safely and efficiently.

Customer-Focused Approach:

Flexible and personalized solutions to meet the unique needs of each client.

WE ARE HERE TO HELP

Most Popular Questions.

If you don’t find an answer here, scroll down and send us a message.

- It would be best to have a Mexican Customs Broker for shipments over 1,000usd.

- Subscribed to the importer register (Padron de Importadores) of SAT or hired commercial business services, a subscriber in importers registers. For specific shipments, being a subscriber in the sectorial importers register.

- A commercial invoice with all legal requirements.

- A supplier origin certificate.

- Have all authorizations, NOMs, or permissions needed for import.

- Pay taxes and import rights.

There are two types of imports or exports: temporary or definitive.

- Definitive import or export are those where you must pay taxes and import rights, and the shipment will not return to the origin country.

- Temporary imports or exports are subject to a process and later will return to the country of origin. The main programs are maquiladoras and pitex.

It is a control system run by the Mexican government that verifies all import and export shipments.

This system works by checking shipments randomly. Many factors determine if import or export shipments need to be exhaustly checked out by Mexican authorities, like the type of shipment, harmonized tariff, or the importer or exporter itself.

A computer reads the entry bar code and registers this number in the customs system. There are two colors; green lets you pass through without inspection, and on the other side red color means it is going to be inspected by import or export authorities personnel.

If the shipment gets a red light, it will be inspected by authorized personnel and checked again for a second Mexican custom system selection.

It is a type of Mexican government tariff regulation. Mexico determines if a specific country subsidizes a product under its costs, competing disloyally with nationals.

Also, the Mexican government uses this regulation for products that can damage some economic sectors.

NOMS are nontariff regulations for securing international quality standards.

In Mexico, there are two types of NOMs: NOM for labeling and NOM for commercial information or quality and specifications.

Labeling NOMS: label the product according to its tariff classification.

Quality NOMS: it is due to have authorization by SECOFI and signed by an authorized laboratory.

Padron de Importadores / Padron Sectorial

It is a national registry of importers. There are two types of registry: the register of importers, which records all importers in the country, and the sectorial register, which is due to be when concerns sensible products to the economy.

Except for certain products, you need the importers' registration before being able to make an import or export.

International Commerce Terms. INCOTERMS are used terms of international trade sale and determine what includes on product price between two companies and their responsibilities on purchase and sale transaction.

- Supplier name and direction. No P.O. Box.

- Phone.

- Supplier Tax ID.

- Product description. No abbreviations or codes.

- Product unit and total price.

- Product origin.

- All products must have a commercial value.

Note: $0.00 are not accepted in customs, including samples or gifts. - INCOTERM is provided in the instruction letter.

Value in customs consists in:

- Total invoice.

- Loading and unloading expenses.

- Storages.

- Freights.

It is the base for taxes calculation and import rights.